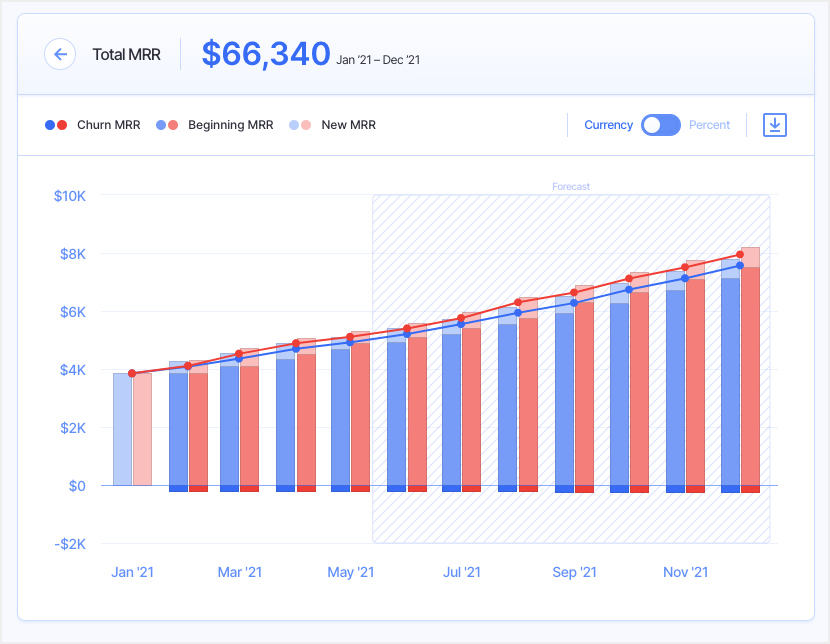

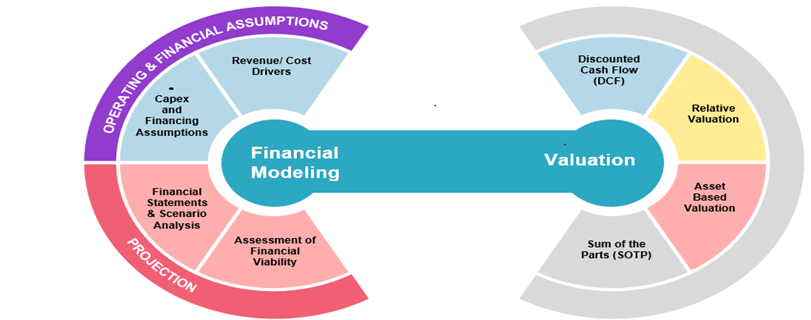

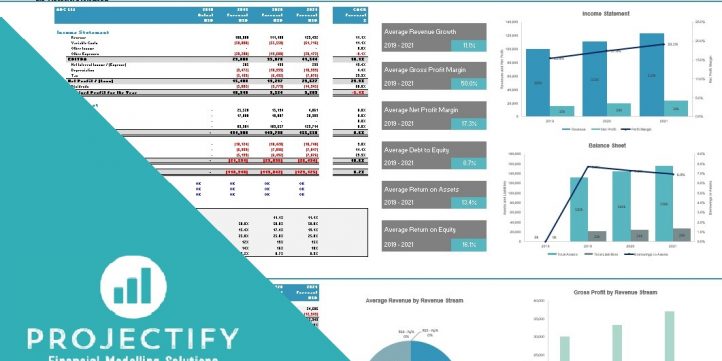

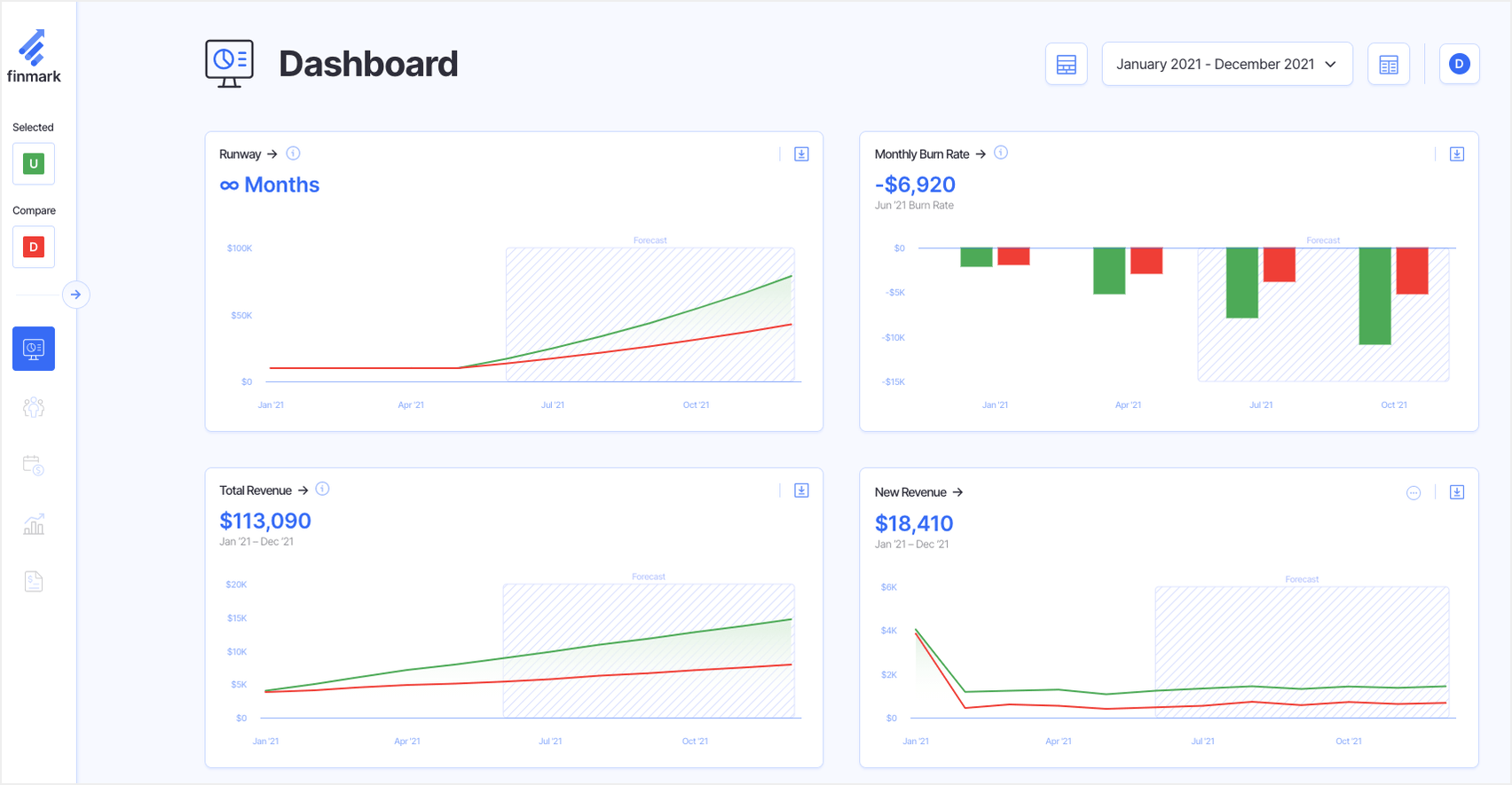

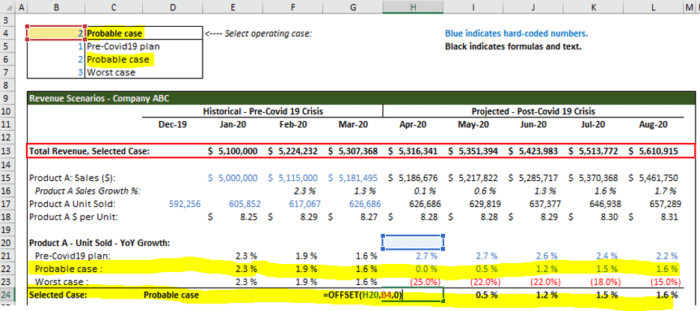

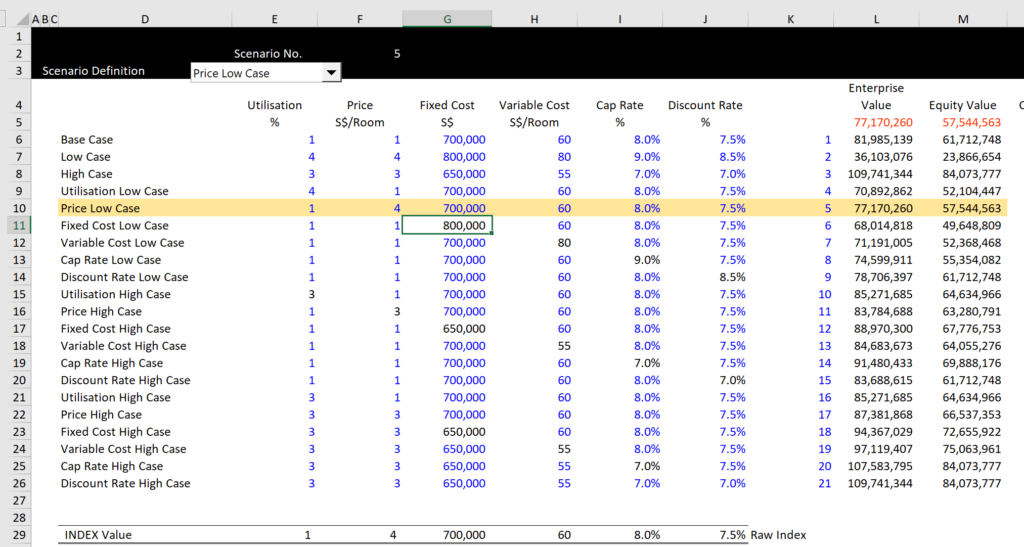

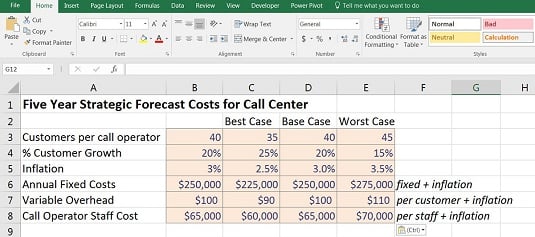

The analysis could include identification of assetspecific financial drivers and creation of scenarios for asset financial models to understand financial impact Creation of a dashboard to monitor signpost market indicators within a sector that indicate an inflection point or movement, enabling quick responses and exposure adjustments Scenario analysis is the process of building, testing, and analyzing different scenarios for your business You'll do this using your financial model Generally speaking, companies have at least three scenarios in their modelScenario analysis is a process of analyzing possible future events by considering alternative possible outcomes Thus, scenario analysis, which is one of the main forms of projection, does not try to show one exact picture of the future Instead, it

Best Practices For Scenario Analysis Financial Modeling Solver

Scenario analysis finance example

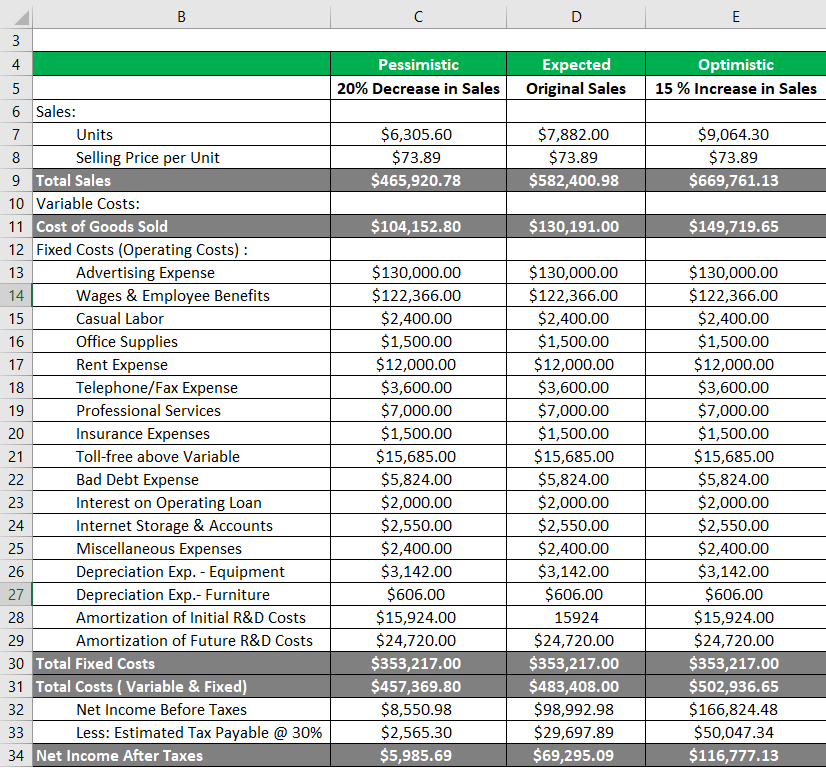

Scenario analysis finance example-Scenario analysis is a process of examining and determining possible events that can take place in the future by considering various feasible results or outc Scenario analysis is an incredibly useful tool for investors of all skill levels Simply put, scenario analysis allows individuals to explore the consequences of specific market scenarios

Scenario Analysis Guide For Finance Professionals By Datarails

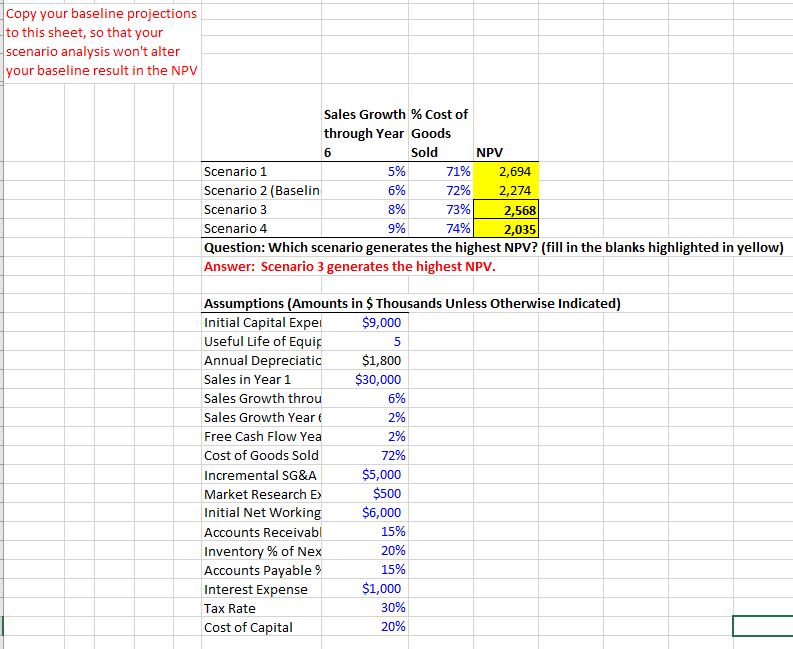

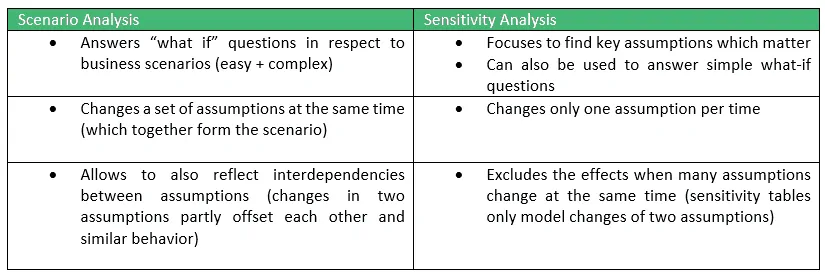

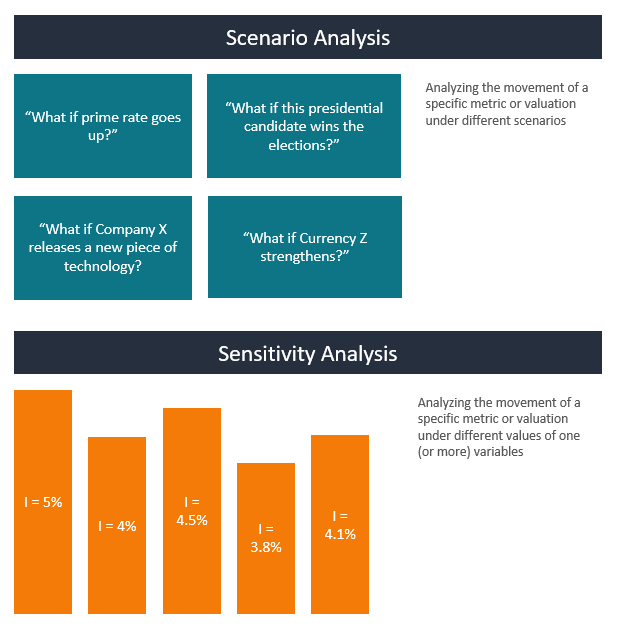

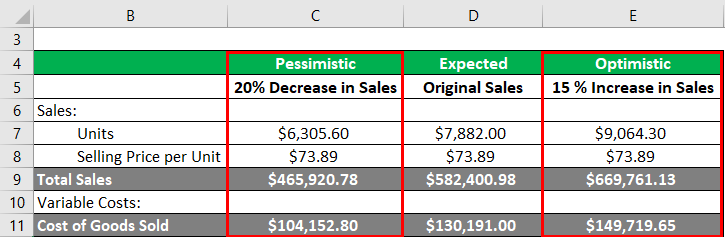

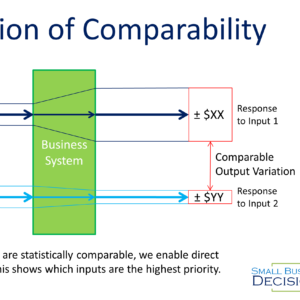

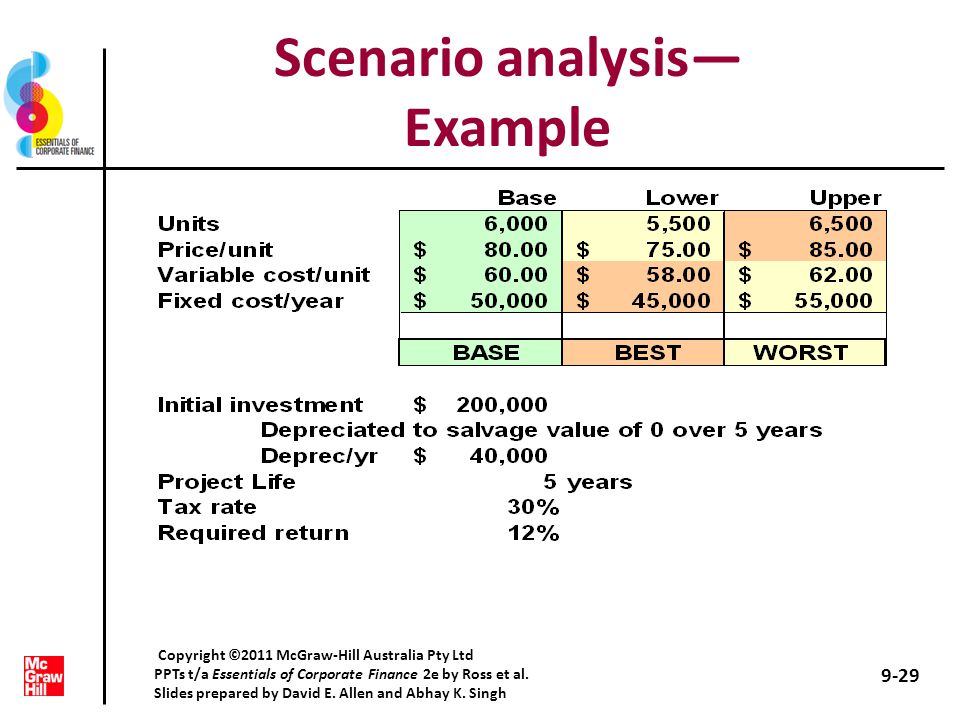

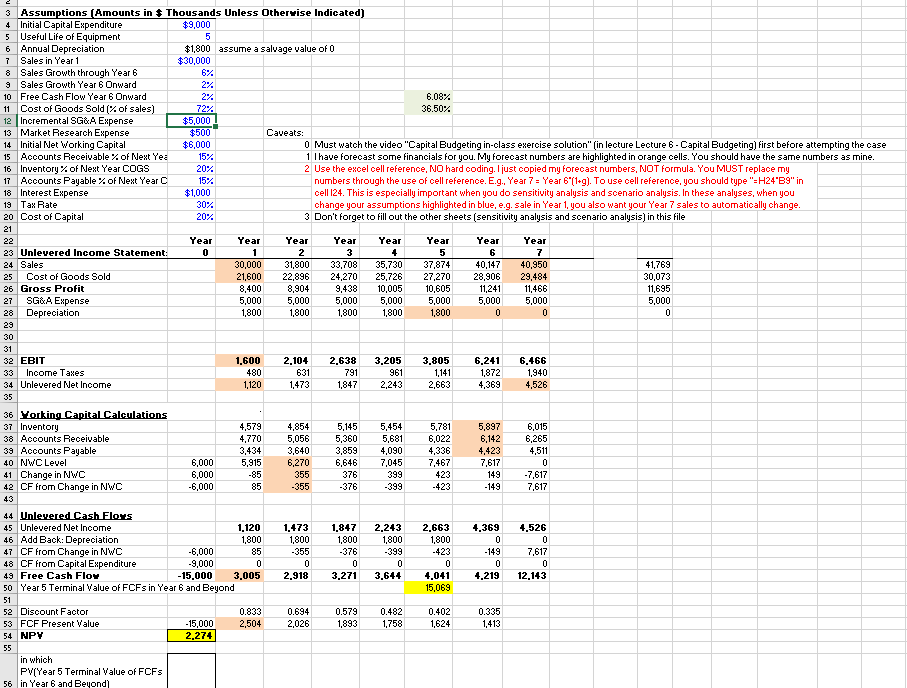

Scenario analysis is designed to see the consequences of an action under different set of factors Scenario analysis takes sensitivity analysis a step further Rather than just looking at the sensitivity of the NPV analysis to changes in the variable assumptions, scenario analysis also looks at the probability distribution of the variables Scenario Analysis is the method of predicting the future value of an investment based on changes that may occur to existing variables It requires one to explore the impact of different market conditions on the project or investment as a whole This type of analysis is often used to estimate changes in cash flow or business value 1 Introduction Scenario analysis is an important tool in decision making It has been used for several decades in various disciplines, including management, engineering, defense, medicine, finance and economics

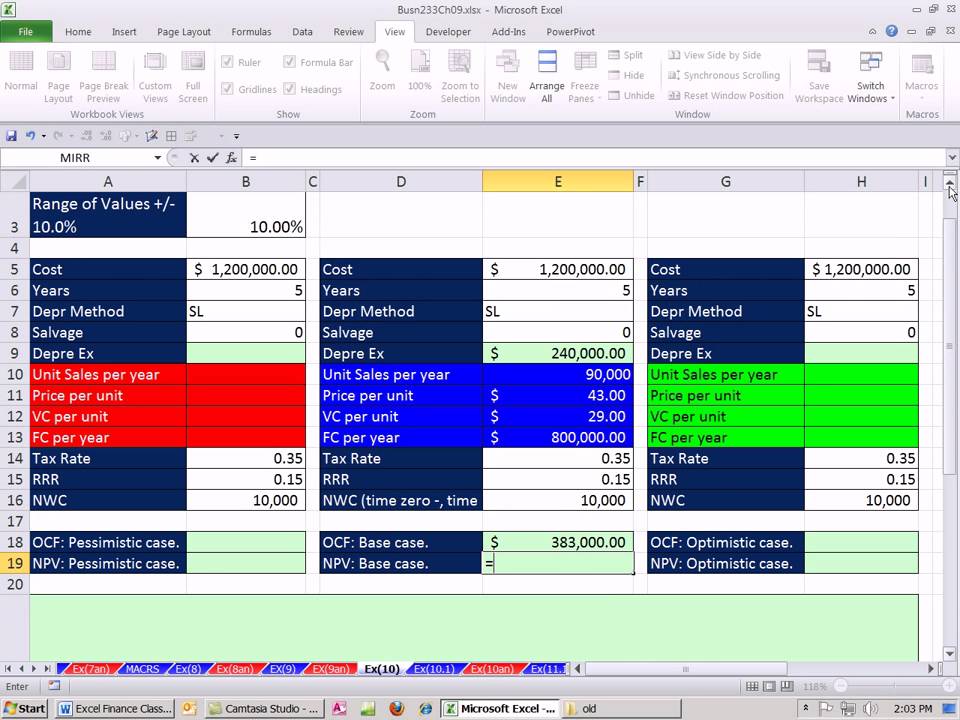

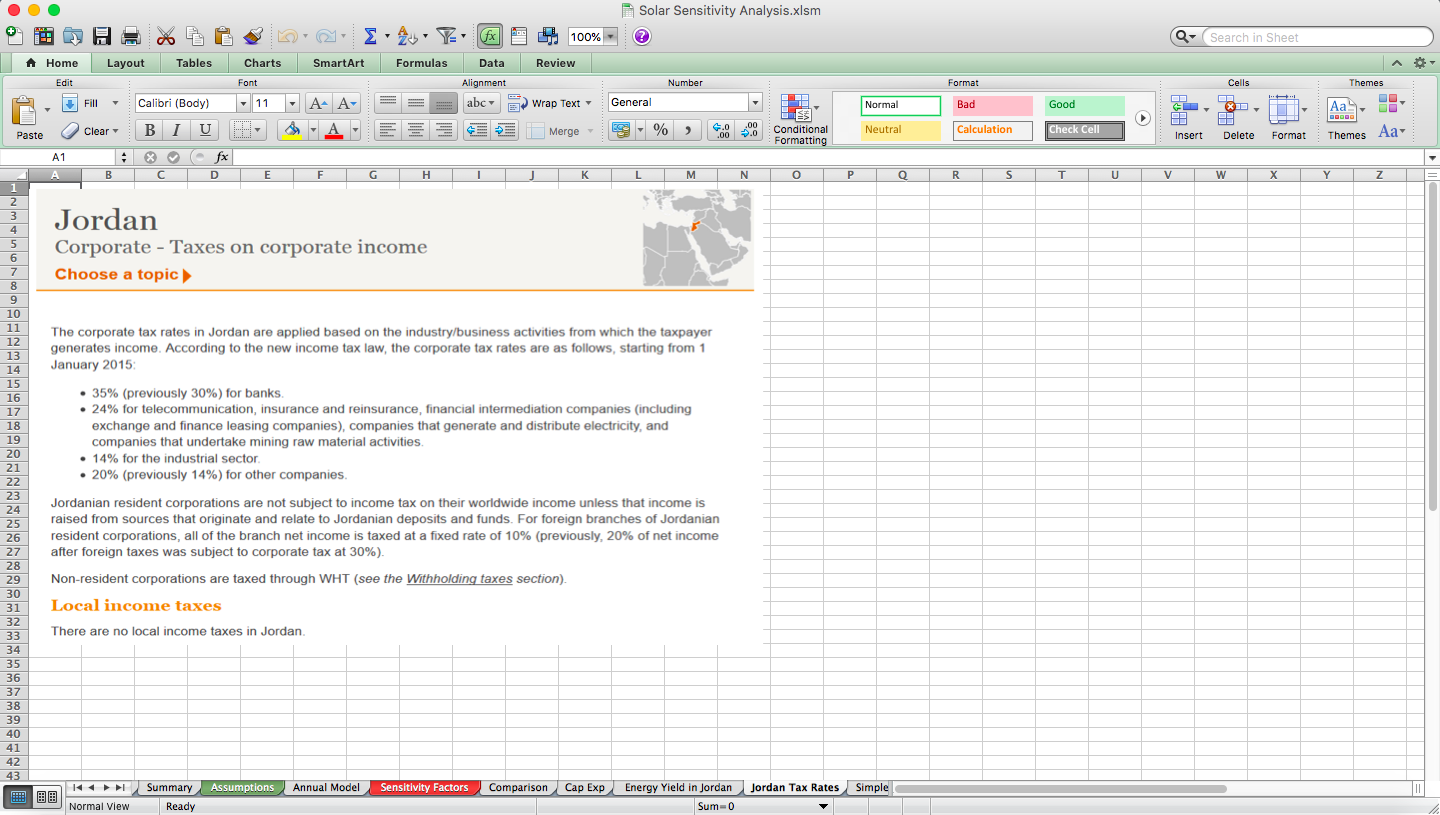

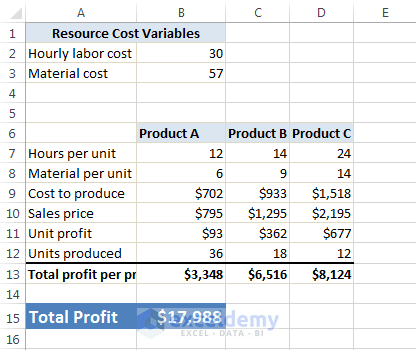

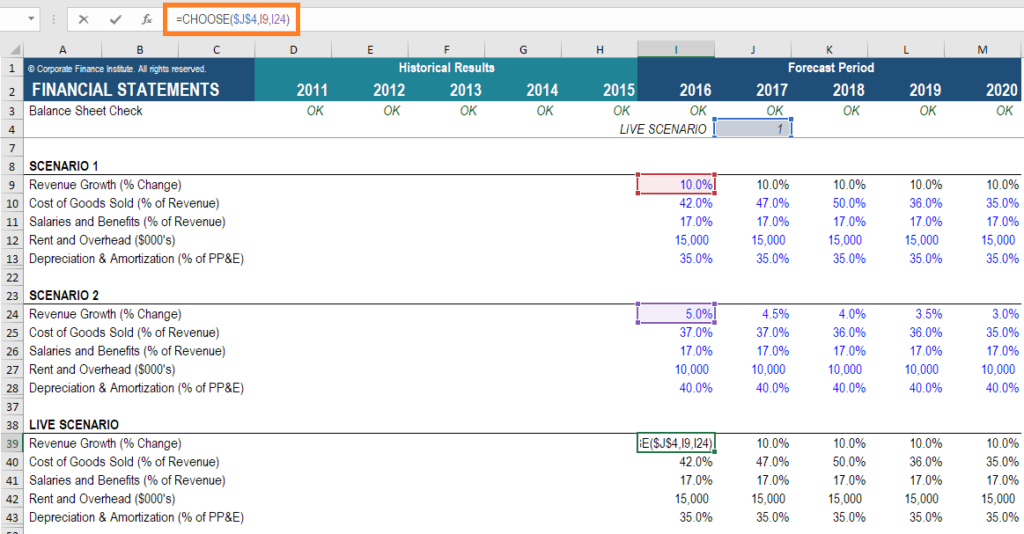

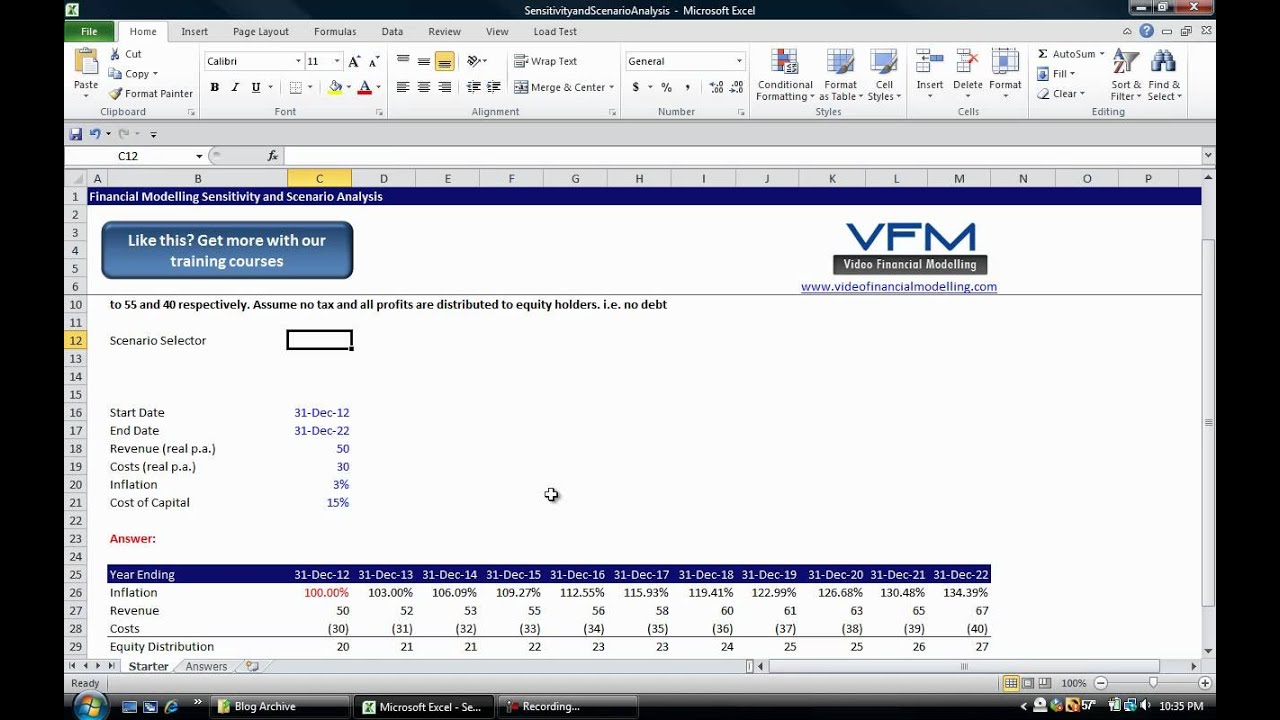

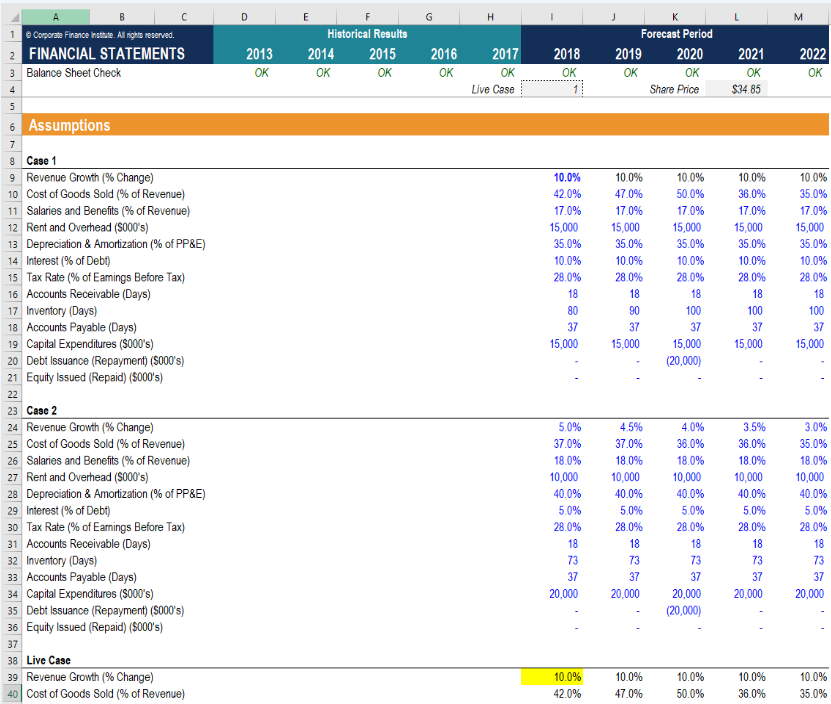

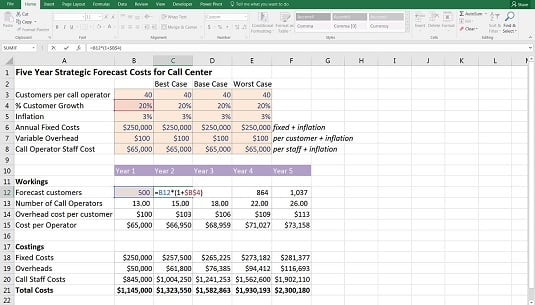

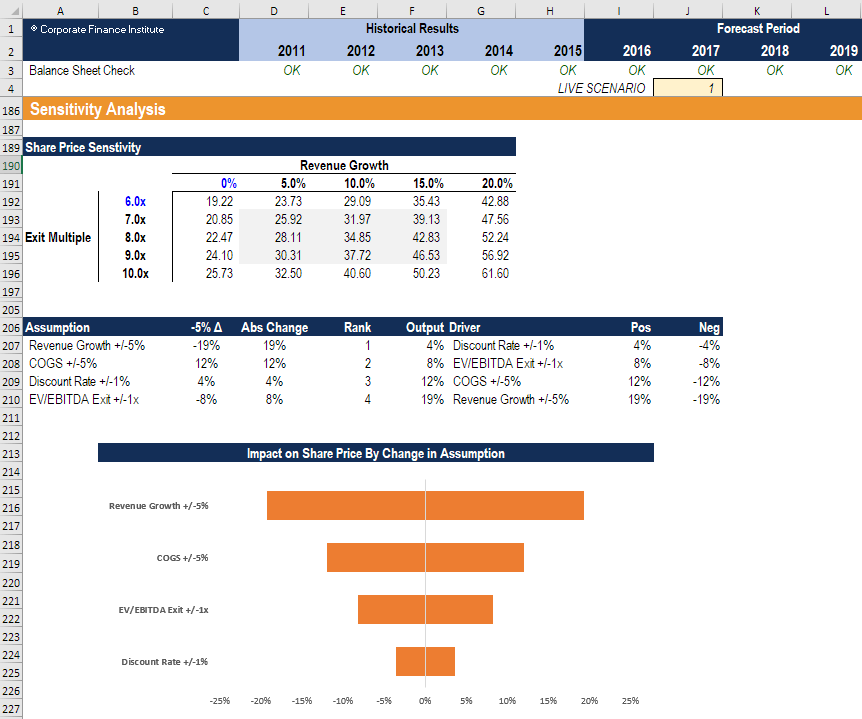

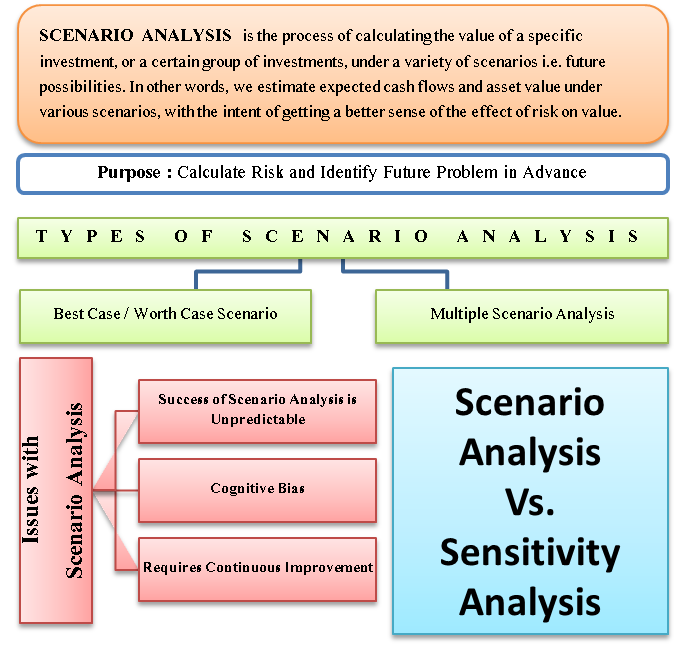

Description The following Excel template is a model used for sensitivity and scenario analysis (or WhatIf analysis) The Excel template provides 2 types of data tables; Scenario Analysis is the process of calculating the value of a specific investment, or a certain group of investments, under a variety of scenarios ie future possibilities In other words, we estimate expected cash flows and asset value under various scenarios, with the intent of getting a better sense of the effect of risk on value Scenario Analysis can be defined as the process of estimating the futuristic and expected value of the portfolio after the specific fulcrum of time frame The entire process of the Scenario Analysis assumes the specific changes or alterations in the values of the portfolio's securities change in the interest rates and the consideration of other market dynamics

What is scenario analysis?Scenario analysis software allows finance professionals to manage potential risks while positioning their organizations to capitalize on lucrative financial outcomes Synario is the key to performing effective and timeefficient scenario analysis Scenario analysis is the process of analyzing and assessing potential future occurrences or scenarios and anticipating the many probable results or outcomes The approach is generally used in financial modeling to estimate changes in the value of a firm or cash flow, mainly when there are potentially favorable and adverse events that could affect the organization

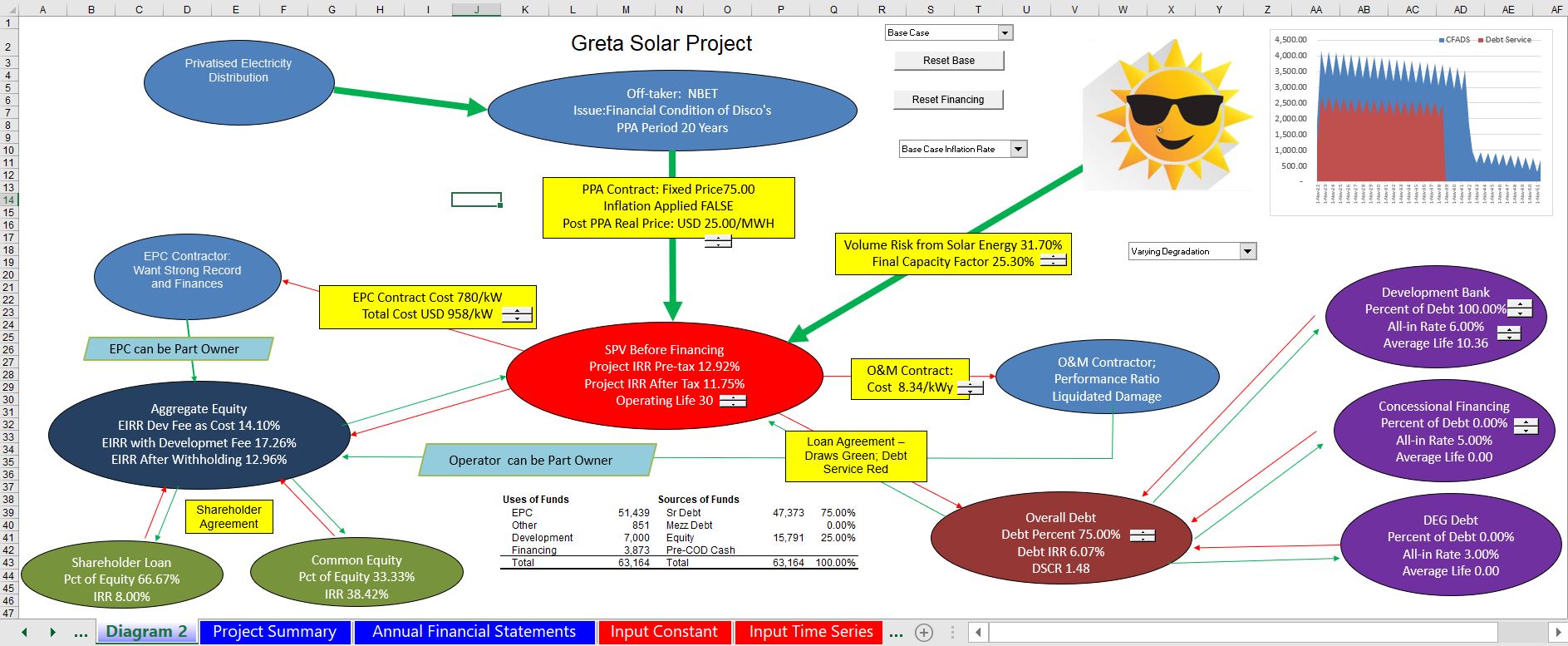

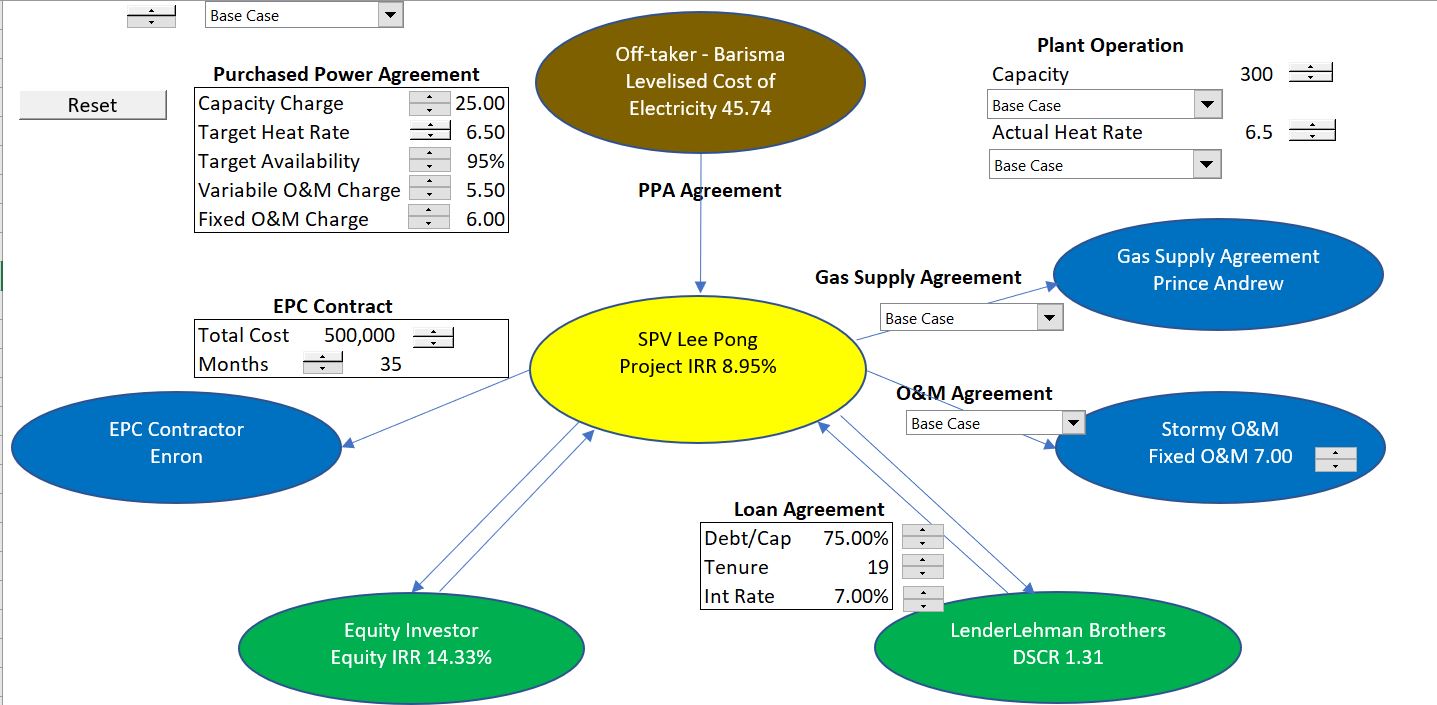

Scenario With Spinner Edward Bodmer Project And Corporate Finance

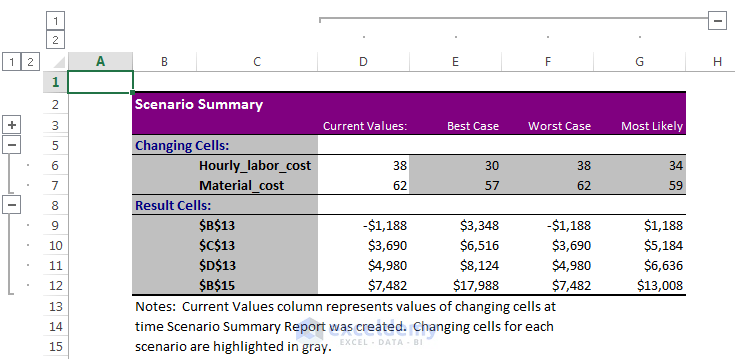

How To Do Scenario Analysis In Excel With Scenario Summary Report

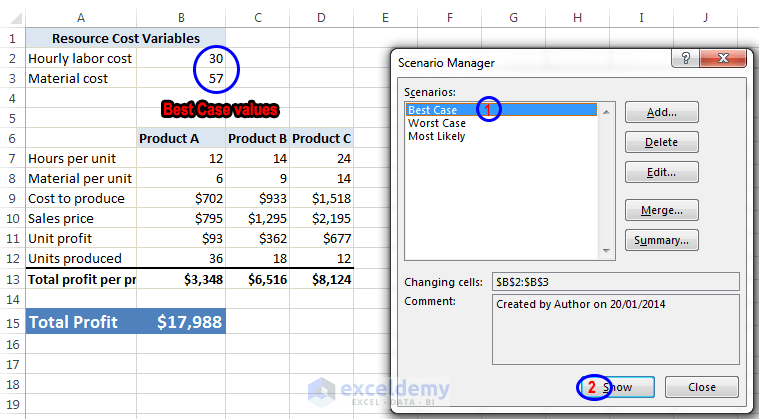

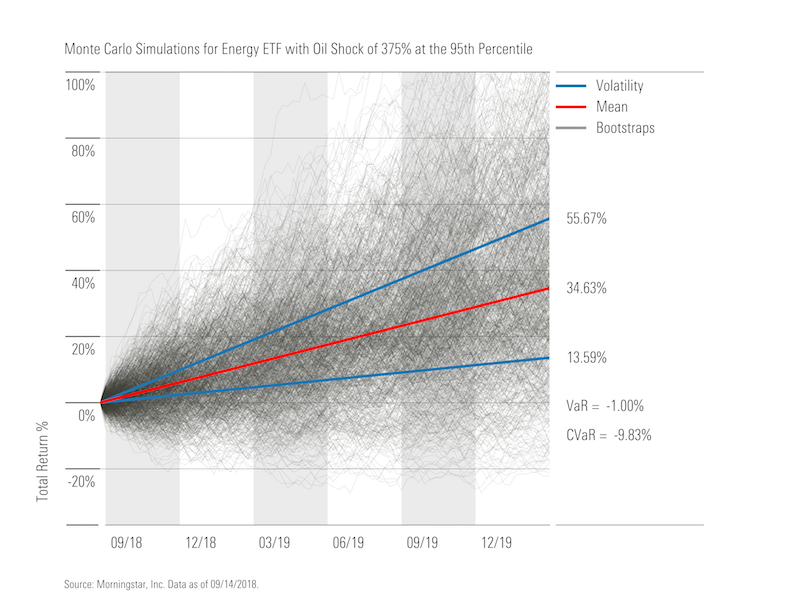

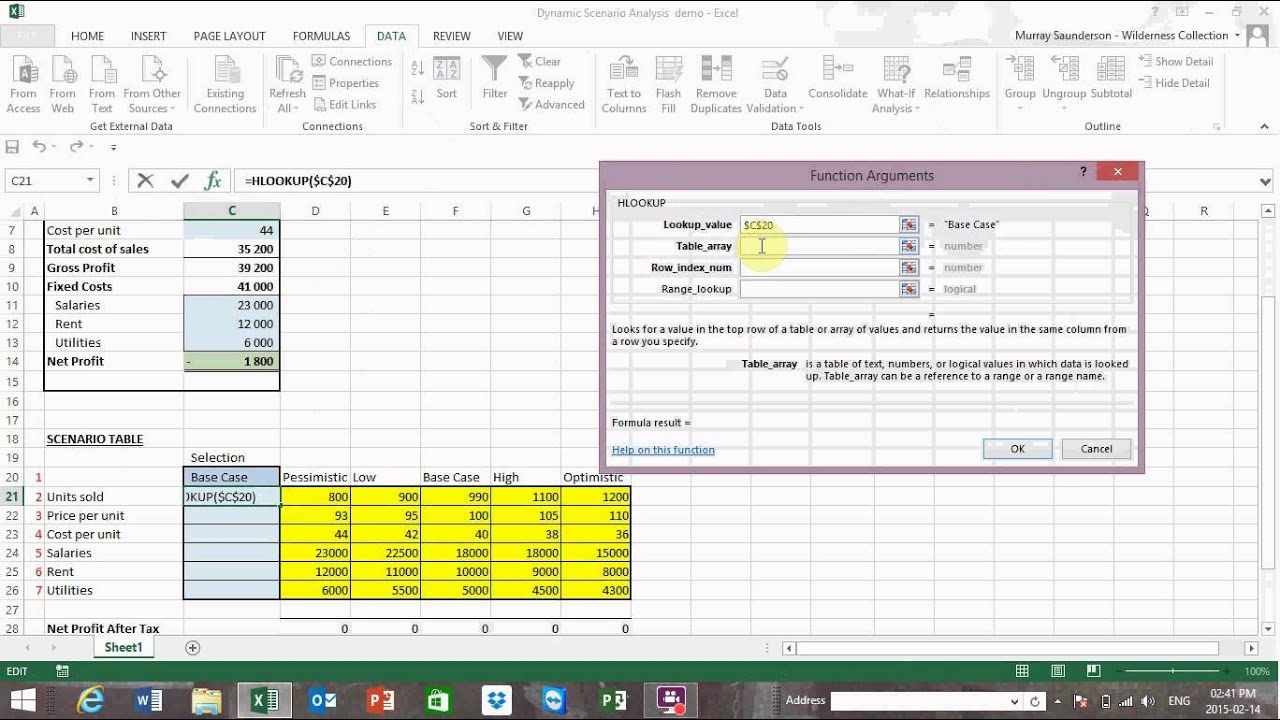

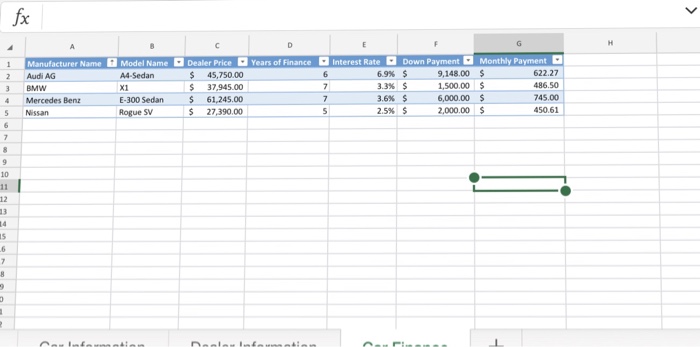

Scenario and sensitivity analysis course overview This advanced financial modeling course will teach you how to perform Excel sensitivity analysis with a focus on practical applications for professionals working in investment banking, equity research, financial planning & analysis (FP&A), and finance functions1way data table and a 2way data table The 1way data table is used for when we want to see how sensitive an output is (or many outputs are) when set against the changes of The higher the number of simulated scenarios, the higher the precision Finally, the results of all the simulations are analyzed For example, typical scenario analysis of a financial portfolio can be related to risk (eg what's the probability that our

Scenario With Spinner Edward Bodmer Project And Corporate Finance

Scenario Analysis Of Financial Models Magnimetrics

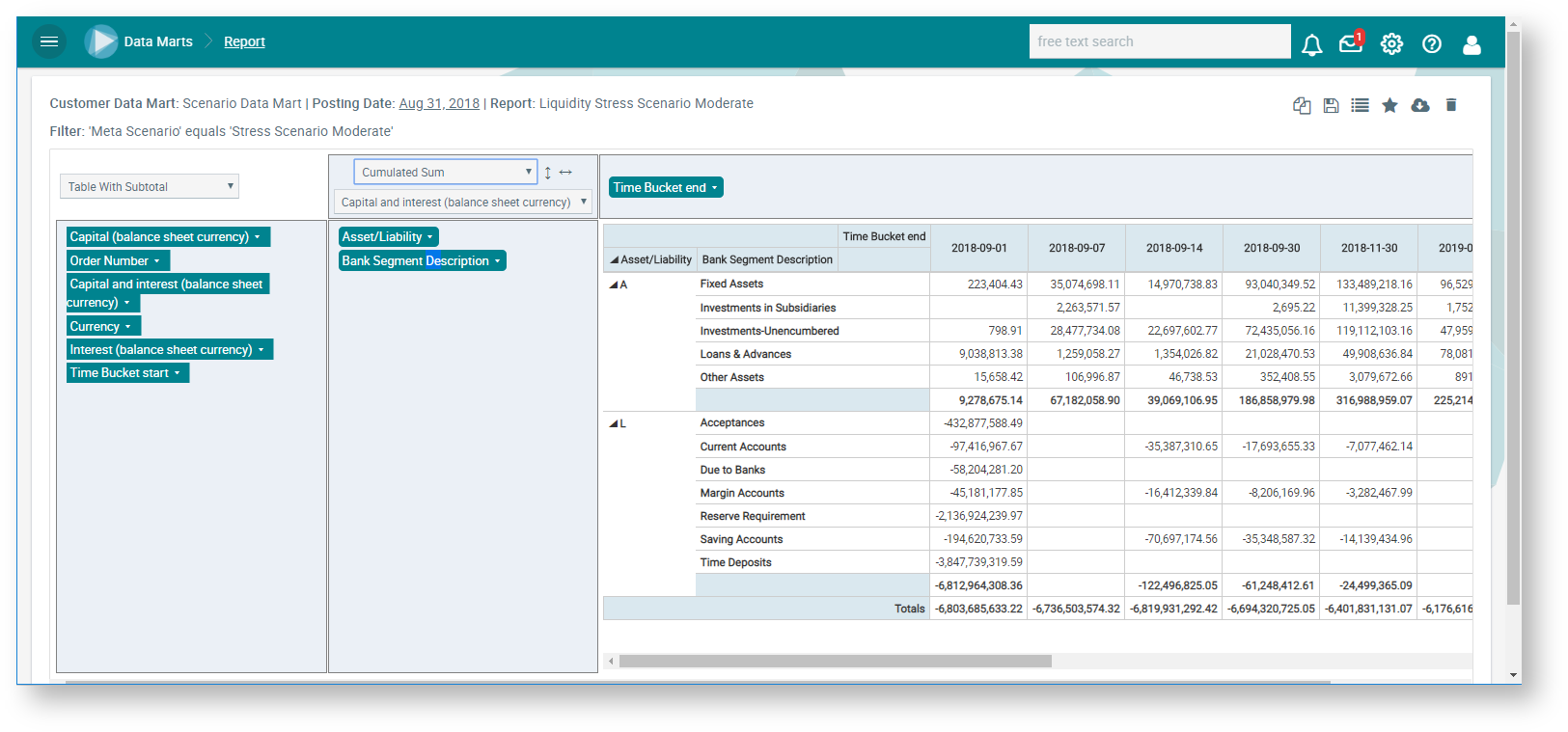

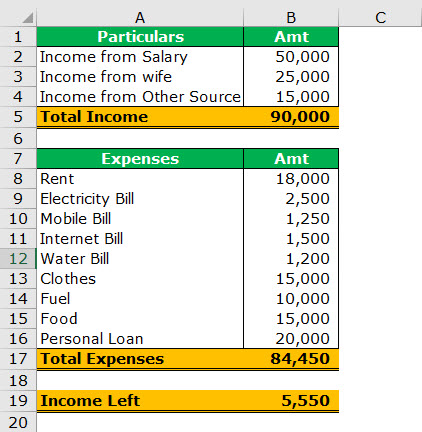

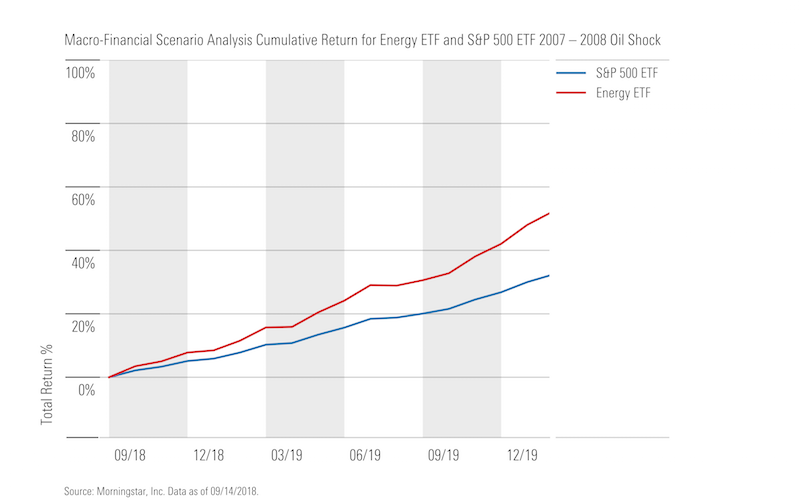

You can use stress testing to conduct scenario analysis on a hypothetical scale but you can also reference historical events to conduct your analysis For instance, you might attempt to simulate how your portfolio would react in an environment similar to the one created by the 08 financial Scenario analysis is crucial for small businesses as smaller companies may be more heavily affected by a single event Scenario analysis is used by financial services companies to analyze risk and make investment decisions, but you can also use it to analyze your household financesScenario analysis is the process of estimating the expected value of a portfolio after a given change in the values of key factors take place Scenario analysis can apply to investment strategy as well as corporate finance

Scenario Analysis Building Scenarios In Financial Models Example

How To Do Scenario Analysis In Excel With Scenario Summary Report

Scenario analysis, sensitivity analysis and whatif analysis are very similar concepts and are really only slight variations of the same thing All are very important components of financial modelling – in fact, being able to run sensitivities, scenarios and whatif analysis is often the whole reason the model was built in the first placeWe would like to introduce you to an important concept in financial modeling Scenario analysis This key concept takes your financial model to the next level by allowing you the flexibility to quickly change the assumptions of the model and reflect important changes that may have taken place in regard to the company's operationsStress and Scenario Analysis PRM Exam III, Risk Management This lesson is part 6 of 10 in the course Credit Risk Management Basel II has laid out detailed norms for stress test and scenario analysis Areas covered include stress testing methodologies, scenario selection, supervision, etc In the financial recession of 08, many banks

Scenario Analysis How To Build Scenarios In Financial Modeling Youtube

Scenario Analysis Guide For Finance Professionals By Datarails

Guidance on Scenario Analysis for NonFinancial Companies October The Task Force on Climaterelated Financial Disclosures Executive Summary Climate change is spawning a host of longterm and shortterm effects that affect businesses broadly and fundamentally TheScenario analysis is a tool to enhance critical strategic thinking A key feature of scenarios is that they should challenge conventional wisdom about the future In a world of uncertainty, scenarios are intended to explore alternatives that may significantly alter the basis for "businessasusual" assumptions Finance Scenario Analysis Marc Melaina, Brian Bush, Michael Penev National Renewable Energy Laboratory 15 US DOE Hydrogen and Fuel Cells Program and Vehicle Technologies Office Annual Merit Review and Peer Evaluation Meeting Arlington, VA

Causal Capital What Is Scenario Analysis To Op Risk People

Scenario Analysis How To Build Scenarios In Financial Modeling

Demystifying Climate Scenario Analysis for Financial Stakeholders • Quantifying climate risks under different scenarios is a key element in understanding how physical climate risks pose financial risks • Scenario analysis is often approached from the perspective of transition risk, where policy developments andScenario analysis is best performed when you have a fullfield view of an organization's financial health Without the ability to view each aspect of a business, whether internal or external, a given project or initiative may be executed in a way that is harmful to the business What is "Scenario and Sensitivity Analysis"?

Sensitivity Analysis Learn Advanced Excel Analysis Cfi

Seminar In Finance Can You Please Help Me Figure Chegg Com

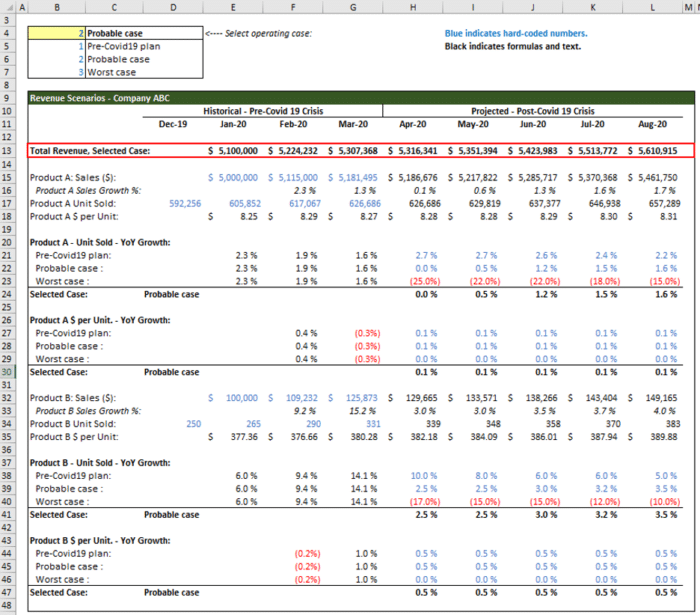

Guide to Building Scenario Analysis for Financial Models The base case is the case we have in the financial model built We assume that Revenue Growth for 19 is 143% for all three scenarios But for 23 it might go down or up depending if it's Upside (Step = 15%) or Downside (Step = 2%) case 1Definition and meaning Scenario analysis is a way of predicting future values based on certain potential events Experts use scenario analysis to predict what might happen to an investment portfolio, for example, if specific events occur or don't occurFinancial analysts determine when to use scenario analysis vs sensitivity analysis to predict future results In turn, business leaders can determine the impact of certain business decisions Both analyses help companies gain a better understanding of their potential outcomes Ultimately, both scenario and sensitivity analysis help companies

Using Scenario Analysis For Your Portfolio Smartasset

Why Sensitivity Analysis Matters Efinancialmodels

Scenarios uncover inevitable or nearinevitable futures A sufficiently broad scenariobuilding effort yields another valuable result As the analysis underlying each scenario proceeds, you often identify some particularly powerful drivers of changeScenario analysis is designed to see the consequences of an action under different sets of factors For example, it shows how an investment 's NPV would differ under high and low inflation Scenarios should be feasible enough to provide an accurate picture of the outcomesAccording to the Corporate Finance Institute, scenario analysis is a process of examining and evaluating possible events that could take place in the future by

Financial Models Judging The Numbers

Scenario Analysis Of Financial Models Magnimetrics

Scenario analysis is the process of forecasting the expected value of a performance indicator, given a time period, occurrence of different situations, and related changes in the values of system parameters under an uncertain environmentScenario planning, scenario thinking, scenario analysis, scenario prediction and the scenario method all describe a strategic planning method that some organizations use to make flexible longterm plans It is in large part an adaptation and generalization of classic methods used by military intelligence In the most common application of the method, analysts generate simulation gamesScenario Analysis in Finance The process used in examining potential investment scenarios can also be applied to various other financial situations to examine value shifts based on theoretical scenarios A consumer can use scenario analysis to calculate the different financial outcomes of purchasing an item on credit

Excel Finance Class Scenario Analysis For Cash Flow Npv Calculations Youtube

Stress Scenario Analysis Flexfinance Flexfinance Finance

Scenario and sensitivity analysis helps a financial modeler to understand the major drivers of a project or business In addition to this, one needs to understand the project or business's capability of withstanding various scenarios, such as a downturn in the economyScenario analysis is the process of predicting the future value of an investment depending on changes that may occur to existing variables It requires one to explore the impact of different market conditions on the project or investment as a whole Scenario analysis is a method used for estimating the anticipated value of a holding or securities after a specific variation in the values of the primary factor Both the worstcase situations and likely conditions can be tested with this process Computer simulations often carry the process It can be applied in both corporate finance and

Scenario And Simulation Assessments Boundless Finance

Risk Analysis In Project Finance Modelling November

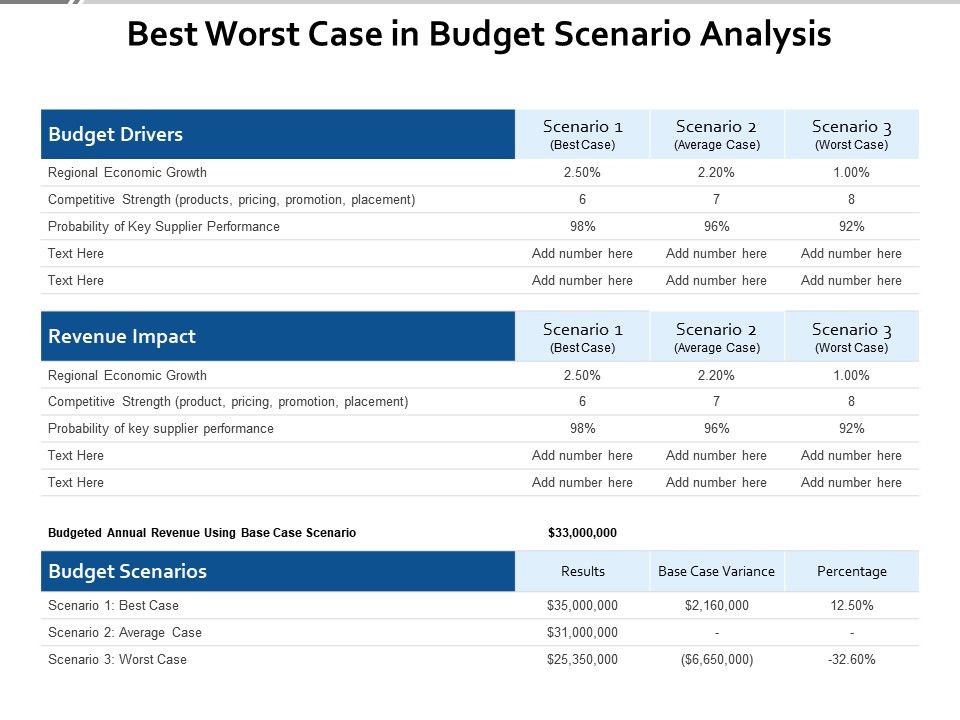

Scenario analysis is a whatif analysis in which a model's output is calculated for a number of scenarios Scenario analysis is most commonly used in finance to estimate the expected value of an investment in a number of situations (such as best case scenario, base case scenario and worst case scenario)Financial model excel templates that provides scenario analysis for industrial companies, ecommerce industries, food and beverages and other industries Scenario Analysis chapter 1 Introduction Purpose This climate change Scenario Analysis chapter provides practical guidance on how to use scenario analysis to assess climaterelated financial risks to inform firms' strategy and business decisions It was written by a crossindustry working group under the auspices of the Climate Financial Risk

Scenario Analysis Photos Free Royalty Free Stock Photos From Dreamstime

1

A method for the assessment of a risky investment project based on information about possible realizations for some, or all, macroeconomic and projectspecific factors that determine the value of the project A variant of scenario analysis is bestcase/worstcase analysis, where each factor is assumed to take the best possible value and the worst possible value;This tutorial analyzes advanced financial modeling tools provided by Excel 10 to create multiple financial scenariosFinance Scenario Analysis Introduction Scenario 1 Increased expenses used in financing Increasing the level of expenses alongside increased revenues in the overall leads to a decrease in the EBIT The increase in the amount of expenses happens to be at a higher rate than that the increase in the revenue and this depreciates the level

What Does Scenario Analysis Mean Quora

Scenario Analysis Vs Sensitivity Analysis Key Differences Example

Scenario analysis analyzes alternative futures and how business strategies might best cope with them Scenarios ask what might happen if • Competitors introduce (or do not introduce) new and better products • Laws change to allow new types of products or services to be marketed or to restrict old ones

Scenario Analysis 3 Statement Projection Efinancialmodels

Scenario Analysis Example 80 Consulting Posts

Embedding Environmental Scenario Analysis Into Routine Financial Decision Making In Mexico And South Africa Cambridge Institute For Sustainability Leadership

Scenario Analysis Guide For Finance Professionals By Datarails

1

3 Statement Financial Model Guide Wall Street Prep

Scenario Analysis In Risk Management Theory And Practice In Finance Economics Books Amazon Com

Enhancing Tcfd Climate Risk Assessments Scenario Analysis Tools Recs

1

Best Practices For Scenario Analysis Financial Modeling Solver

Scenario Analysis Explained Netsuite

Scenario Analysis Building Scenarios In Financial Models Example

Scenario Analysis Guide For Finance Professionals By Datarails

Scenario Analysis Using Macros Eloquens

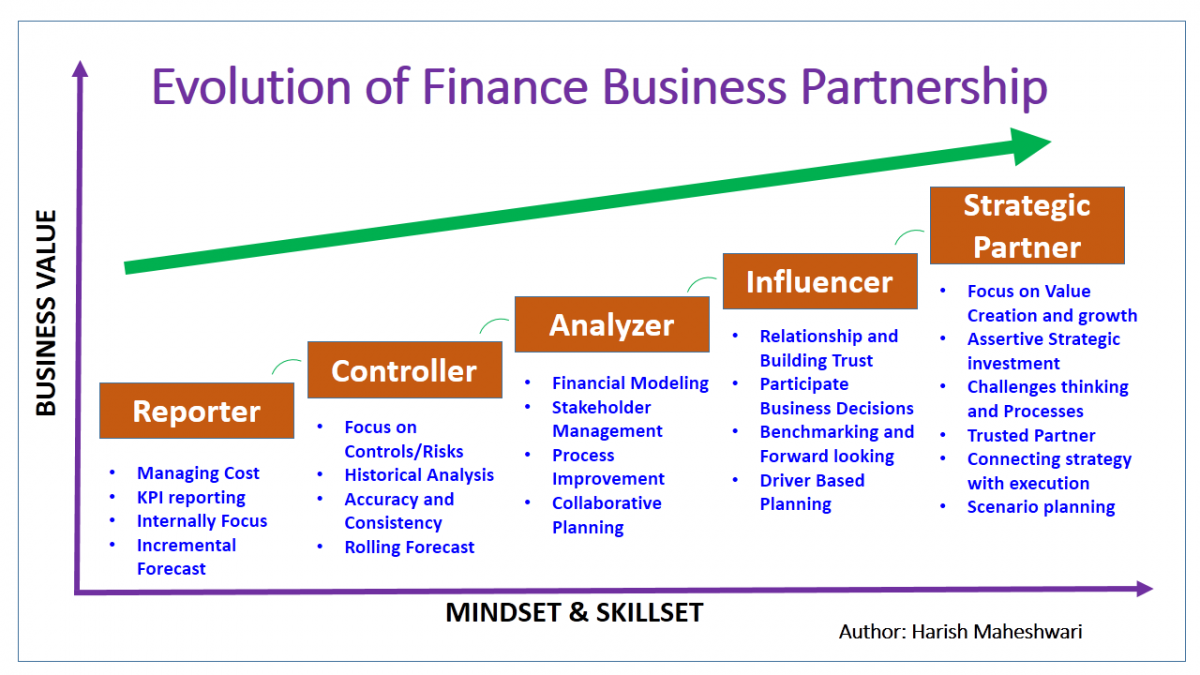

Strategic Finance Business Partnership Becoming A Profit Center Fp A Trends

Amazon Com Scenario Analysis In Risk Management Theory And Practice In Finance Ebook Hassani Bertrand K Kindle Store

Scenario Analysis Explained Netsuite

Content Libraries Generic Financial Model Scenario Analysis Scenarios Within Scenarios Modano

Scenario Analysis A Powerful Force In The World Of Business

Scenario Analysis Slide Team

How To Do Scenario Analysis In Excel With Scenario Summary Report

Scenario Analysis An Overview Sciencedirect Topics

Scenario Manager In Excel How To Use Scenario In Excel

Scenario Analysis Guide For Finance Professionals By Datarails

Non Financial Reporting By Companies And Scenario Analysis Be Cautions With Standardization I4ce

Two Approaches To Buy Side Scenario Analysis Bobsguide

Scenario Analysis Examples 3 Ways To Skin A Scenario Morningstar

Scenario Analysis How To Build Scenarios In Financial Modeling

Financial Modelling Sensitivity And Scenario Analysis Youtube

Scenario Analysis

Publications Task Force On Climate Related Financial Disclosures

Scenario Analysis Modeling In Finance Wall Street Prep

Shaking Up The Scenario Analysis Process Prophix Software

Sensitivity Analysis Excel Example Wall Street Prep

Scenario Analysis Examples 3 Ways To Skin A Scenario Morningstar

Missed Caip Virtual On Climate Scenario Analysis Download Slides

Scenario Analysis Building Scenarios In Financial Models Example

Solved Scenario Analysis Problem In Corporate Finance Course Hero

Sensitivity Analysis Examples Of Sensitivity Analysis

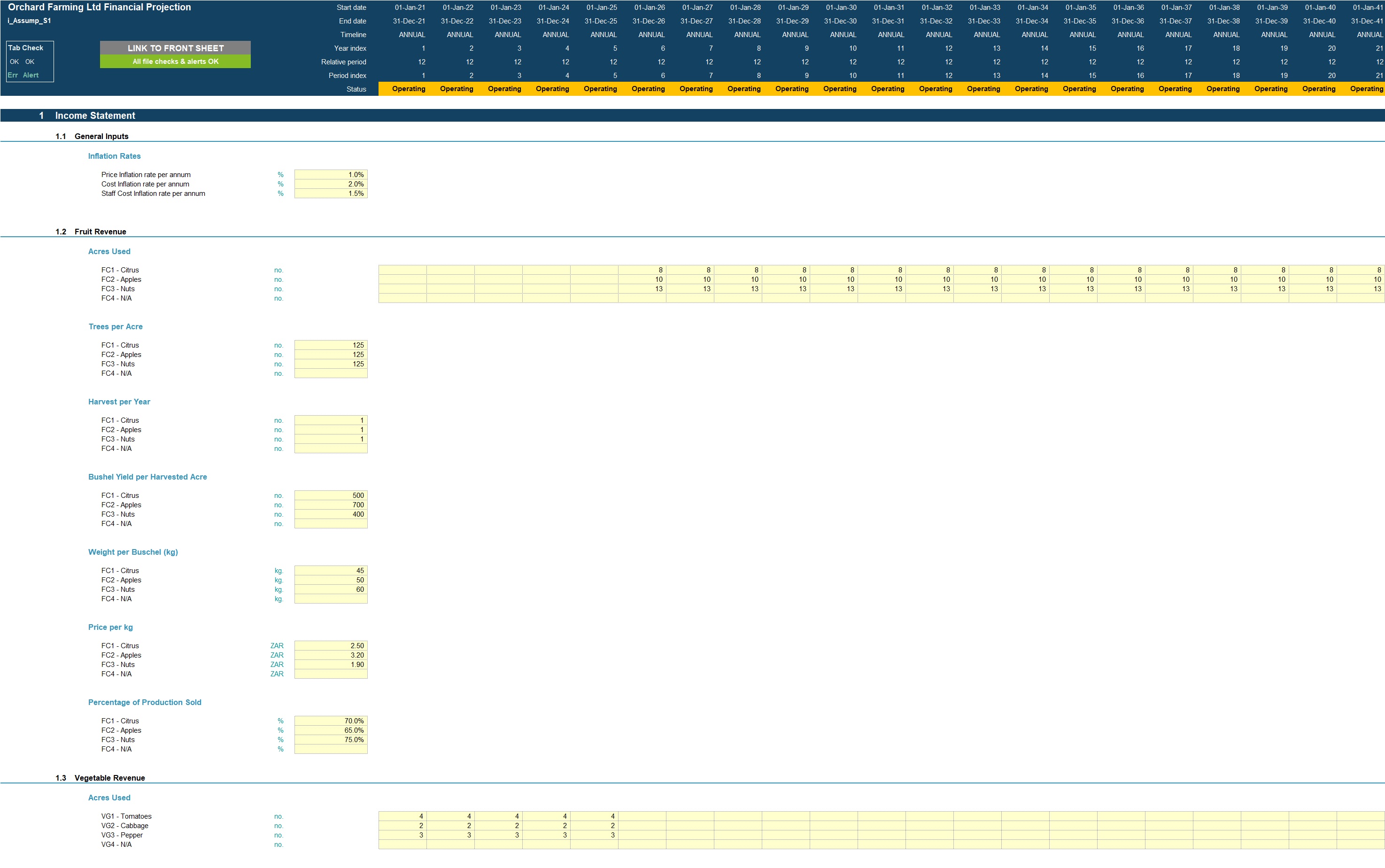

Orchard Crop Farming Financial Projection 3 Statement Model With Scenario Analysis Eloquens

Scenario Analysis Archives Small Business Decisions

Best Worst Case In Budget Scenario Analysis Presentation Graphics Presentation Powerpoint Example Slide Templates

Making Capital Investment Decisions Ppt Video Online Download

1

1 Review Later If You Want To Test How An Increase In Chegg Com

Full Article Scenario Analysis For Derivative Portfolios Via Dynamic Factor Models

Seminar In Finance Can You Please Help Me Figure Chegg Com

Scenario Analysis Example 80 Consulting Posts

Dynamic Scenario Analysis For Excel Youtube

Scenario Analysis How It Adds Value To Your Clients Investment Decision Making The Wealth Mosaic

Basic Scenario Analysis Edward Bodmer Project And Corporate Finance

Scenario Analysis Of Financial Models Magnimetrics

How To Build Drop Down Scenarios In Your Financial Model Dummies

Scenario Analysis Modeling In Finance Wall Street Prep

Sensitivity Analysis Examples Of Sensitivity Analysis

Stress Testing Scenario Analysis Enterprise Finance Solutions Cpb Presentation Powerpoint Images Example Of Ppt Presentation Ppt Slide Layouts

Content Libraries Generic Financial Model Scenario Analysis Scenarios Within Scenarios Modano

Scenario Analysis When Forecasting Vena Solutions

Quant Bible Option Pricing Risk Greeks For Digital Binary Options On Nadex With Scenario Analysis Option Pricing Finances Money Analysis

Best Practices For Scenario Analysis Financial Modeling Solver

Advanced Scenario Analysis Techniques For Power Bi W Dax Youtube

Scenario Analysis An Essential Tool For Db Pension Schemes Lincoln Pensions Ltd

Content Libraries Generic Financial Model Scenario Analysis Scenarios Within Scenarios Modano

Building Scenario Analysis For Financial Models Keyskillset

An Example Of Liquidity Scenario Analysis Implemented By Soft Finance Sa Download Scientific Diagram

Scenario Analysis Guide For Finance Professionals By Datarails

Scenario Analysis Of Financial Models Magnimetrics

Scenario Analysis Rolling Forecasts For Rapid Response Finance Onestream Software

How To Build Drop Down Scenarios In Your Financial Model Dummies

Scenario Analysis An Overview Sciencedirect Topics

Scenario Analysis How To Build Scenarios In Financial Modeling

Hello I Have To Create A Scenario Analysis Using The Chegg Com

How Can I Calculate Break Even Analysis In Excel

Free Scenario Analysis Powerpoint Template Free Powerpoint Templates Slidehunter Com

Overview Of Sensitivity Analysis What Is Sensitivity Analysis

Different Scenarios With Excel Self Referencing If Statements Amt Training

Embedding Environmental Scenario Analysis Into Routine Financial Decision Making In Mexico And South Africa Cambridge Institute For Sustainability Leadership

Building Scenario Analysis For Financial Models Keyskillset

Content Libraries Generic Financial Model Scenario Analysis Scenarios Within Scenarios Modano

Scenario Analysis Purpose Types Issues Vs Sensitivity Analysis Efm

0 件のコメント:

コメントを投稿